Biden grants tuition forgiveness

Many people in America are burdened with the knowledge of others’ student debt as well as their own. Around 60.5% of all graduate school completers have federal student loan debt from graduate schools and nearly 54.2% have debt from their undergraduate studies. For master’s degree holders, 60.0% owe federal student loans for graduate school while 52.8% owe for undergraduate school.

There has been a discussion for many years about tuition and debts that have affected students, which affects the government and America as well. President Joe Biden recently announced his plans for federal student loan debt for Pell Grant recipients and up to $10,000 for others who qualify.

College debt can follow graduates for various agonizing years and it is held over heads and is dreaded until finally paid off. Financial aid can only help students so much and that is only if the student qualifies for it. Some students that want to seek out financial aid find it difficult to receive it if their parents make enough money a year. Even if the student has to pay for their college themselves, they can be barred because of their parent’s financial situation. This, in turn, will put them in a debt that will follow them.

The idea of Biden’s plan has raised suspicions and many arguments. Some argue that obviously, student debt has been a huge burden in America. Around 43 million would have reduced tuition debts, and 20 million would have the tuition taken care of altogether. With this tuition forgiveness, many people would be able to use the large sums of money elsewhere in their lives. It could be enough for a possible car or a down payment for a house. This can raise the living standard of various Americans. Although that may sound appealing, this could possibly be an issue for inflation. Businesses are already struggling due to consumer demand and this may fuel the inflation fire.

A CNBC article discusses that not all economists believe this will raise inflation by much because it was discussed that the debt forgiveness would not be a free $20,000 handout put straight into students’ bank accounts. Instead, students will be relieved of making those painful loan payments throughout the years.

Another argument that has Americans riled up, is the fairness aspect of it. People from older generations say that it is not fair because they had to pay, so the younger generations should too. Some believe that this tuition forgiveness plan penalizes people who have worked hard and saved up to pay for their college and their children’s college, as well as the majority of Americans who did not go to college in the first place.

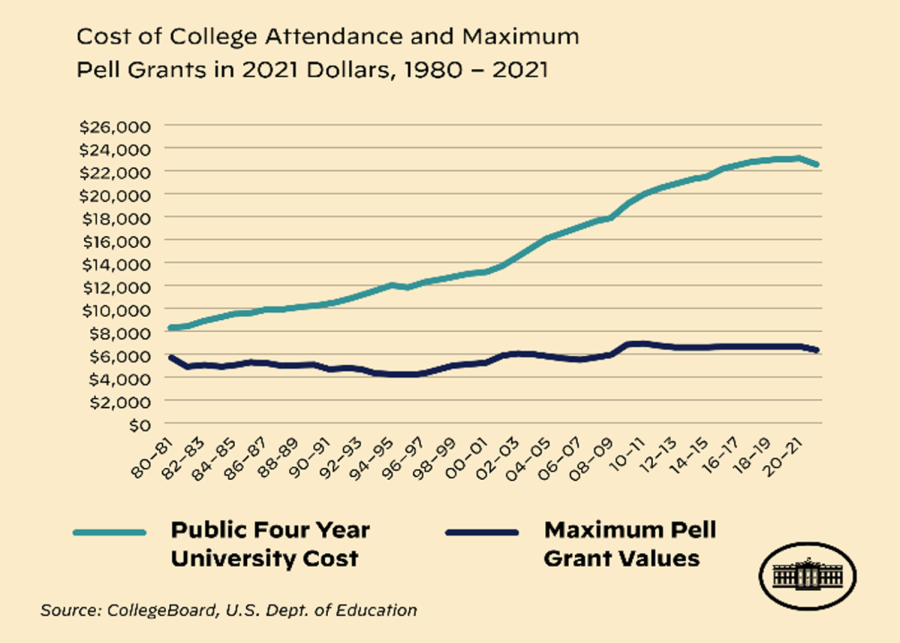

Even though it may be difficult for other generations to acknowledge, times have changed and college is not the same as it once was, especially cost-wise. What would have been a typical amount of student debt 40 years ago is drastically less than the debt that colleges are putting on so many students today.